raleigh nc sales tax calculator

This includes the sales tax rates on the state county city and special levels. Raleigh is located within Wake County North Carolina.

The Ultimate Guide To North Carolina Property Taxes

The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

. Sales Tax Calculator in Raleigh NC. North Carolina has recent rate changes Fri Jan 01 2021. Sales and Use Tax Sales and Use Tax.

The minimum combined 2022 sales tax rate for Raleigh North Carolina is. The base state sales tax rate in North Carolina is 475. Individual income tax refund inquiries.

West Raleigh NC is in Wake County. Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. Wake County is located in North Carolina and contains around 14 cities towns and other locations.

Taxes in Winston-Salem North Carolina are 93 cheaper than Raleigh North Carolina. You can print a 725 sales tax table here. Find your North Carolina combined state and local tax rate.

The most populous county in North Carolina is Wake County. The North Carolina sales tax rate is currently. The state sales tax rate in North Carolina is 4750.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Try our FREE income tax calculator. About our Cost of Living Index. Below 100 means cheaper than the US average.

North Carolina Sales Tax. The December 2020 total local sales tax rate was also 7250. PO Box 25000 Raleigh NC 27640-0640.

Raleigh Pure Tax Resolution. The sales tax rate does not vary based on. Who Should Register for Sales and Use Tax.

How 2021 sales taxes are calculated in raleigh. 30 rows The state sales tax rate in North Carolina is 4750. Real property tax on median home.

With local taxes the total sales tax rate is between 6750 and 7500. The average cumulative sales tax rate between all of them is 725. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222.

Our free online North Carolina sales tax calculator calculates exact sales tax by state county city or ZIP code. Did South Dakota v. The 725 sales tax rate in raleigh consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

The Raleigh sales tax rate is. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in North Raleigh Raleigh NC. The raleigh sales tax rate is 0.

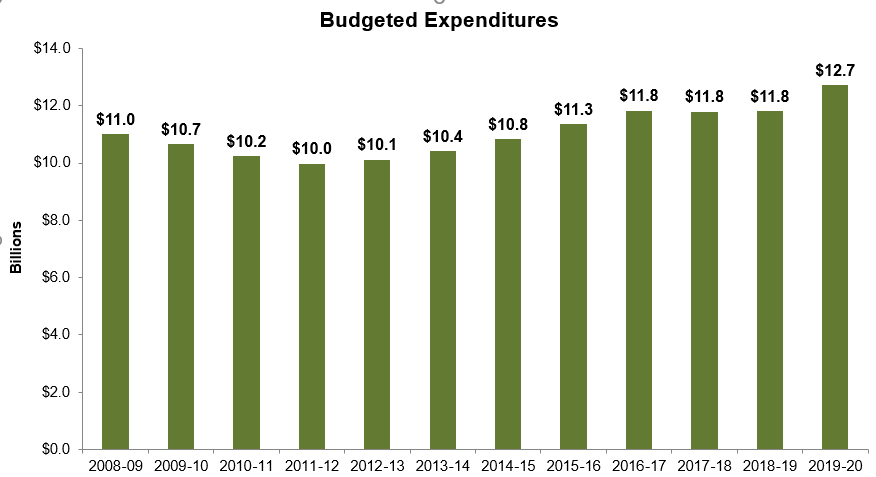

With local taxes the total sales tax rate is between 6750 and 7500. Thus its mainly all about budgeting first establishing a yearly expenditure level. There is no applicable city tax.

Within Raleigh there are around 40 zip codes with the most populous zip code being 27610. Sales Tax State Local Sales Tax on Food. Sales and Use Tax.

The current total local sales tax rate in Raleigh NC is 7250. Start filing your tax return now. As for zip codes there are around 60 of them.

With market values determined Raleigh together with other in-county public bodies will set tax rates independently. Your household income location filing status and number of personal exemptions. North Carolina sales tax rates vary depending on which county and city youre in which can make finding the.

Tax Return Preparation Tax Return Preparation-Business Tax Attorneys 919 948-3355. This is the total of state county and city sales tax rates. US Sales Tax Rates NC Rates Sales Tax Calculator Sales Tax Table.

North Carolina Department of Revenue. Name A - Z Sponsored Links. For tax rates in other cities see North Carolina sales taxes by city and county.

The information included on this website is to be used only as a guide. As far as other counties go the place with the highest sales tax rate is Durham County and the place with. The December 2020 total local sales tax rate was also 7250.

Sales Tax State Local Sales Tax on Food. It is not intended to cover all provisions of the law or every taxpayers specific circumstances. Real property tax on median home.

This takes into account the rates on the state level county level city level and special level. Above 100 means more expensive. TAX DAY NOW MAY 17th - There are -385 days left until taxes are due.

A composite rate will generate anticipated total tax receipts and also generate each taxpayers bills total. The average cumulative sales tax rate in the state of North Carolina is 694. What is the sales tax rate in Raleigh North Carolina.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Raleigh NC.

Overview of Sales and Use Taxes. Here are pictures specs and pricing for the 2022 volkswagen tiguan se located near raleigh. Sales Tax Calculator Sales Tax Table.

2022 Cost of Living Calculator for Taxes. The current total local sales tax rate in West Raleigh NC is 7250The December 2020 total local sales tax rate was also 7250. 025 lower than the maximum sales tax in NC.

A full list of these can be found below. General Sales and Use Tax. 100 US Average.

The most populous location in Wake County North Carolina is Raleigh. The County sales tax rate is. The current total local sales tax rate in West Raleigh NC is 7250.

You can print a 725 sales tax table hereFor tax rates in other cities see North Carolina sales taxes by city and county. The average cumulative sales tax rate in Raleigh North Carolina is 725.

Property Tax In North Carolina

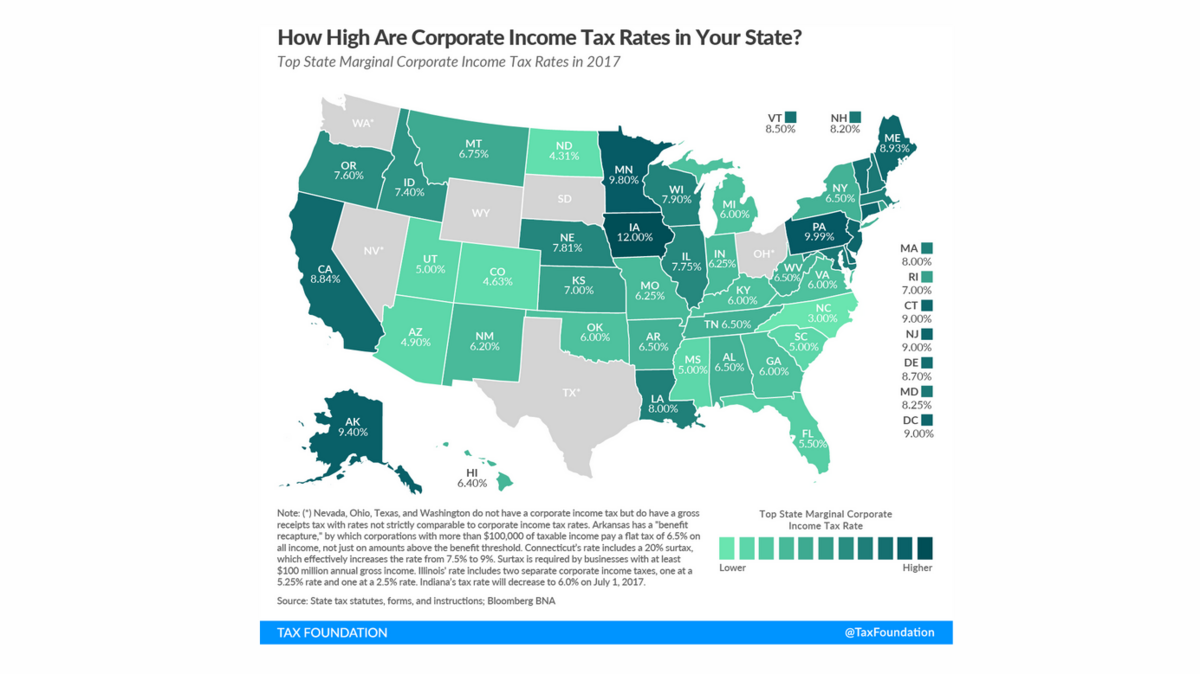

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Sales Tax Guide And Calculator 2022 Taxjar

North Carolina Sales Tax Small Business Guide Truic

North Carolina Sales Tax Rates By City County 2022

Fact Check How Does Biden S Corporate Tax Rate Compare To Other Countries Wral Com

The 5 Best Assisted Living Facilities In Southern Pines Nc For 2022

Tax Foundation Ranks North Carolina 23rd In Sales Taxes

Property Tax Calculator Casaplorer

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

North Carolina Online Sales Tax Raleigh Accounting Firm

North Carolina S Transition To A Low Tax State

North Carolina Sales And Use Tax Audit Guide

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Taxes Wake County Economic Development

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Carteret County Adopts Fy2020 21 Budget With 2 Cent Tax Increase News Carolinacoastonline Com

Colorado Goes Easy On Corporate Income Taxes Denver Business Journal